Africa’s pioneer bank, First Bank of Nigeria, wanted to expand its customer acquisition services beyond the office. To open accounts outside the bank, First Bank of Nigeria would need to empower agents to carry out customer registration with full KYC compliance.

First Bank of Nigeria is a multinational bank and financial services company in Nigeria.

First Bank has an initiative called Agency Banking Platform, which makes banking easier for potential customers through the help of agents.

As account creation in Nigeria’s financial sector involves the use of a government-issued means of identification, one of First Bank’s requirements is for customers to have a National Identification Number (NIN). This is based on regulations listed in Nigeria’s Official Gazette (2017).

First Bank’s Challenge

Many Nigerians who need a bank account are often unwilling to go through with the paperwork and interactions required physically at the bank.

This is due to them wanting to avoid awkward situations where they are unable to provide certain information, or even interact easily with the bank associates.

Because of this, First Bank of Nigeria created an Agency Banking Platform (Field Account Opening) that enables agents to liaise directly with these individuals, through effective communication (often in their local dialect) and a simplified process of opening a functional bank account.

To successfully complete this process, the identities of the potential account owners need to be verified against the information that they provide.

How Verified.africa Solved First Bank’s Challenges

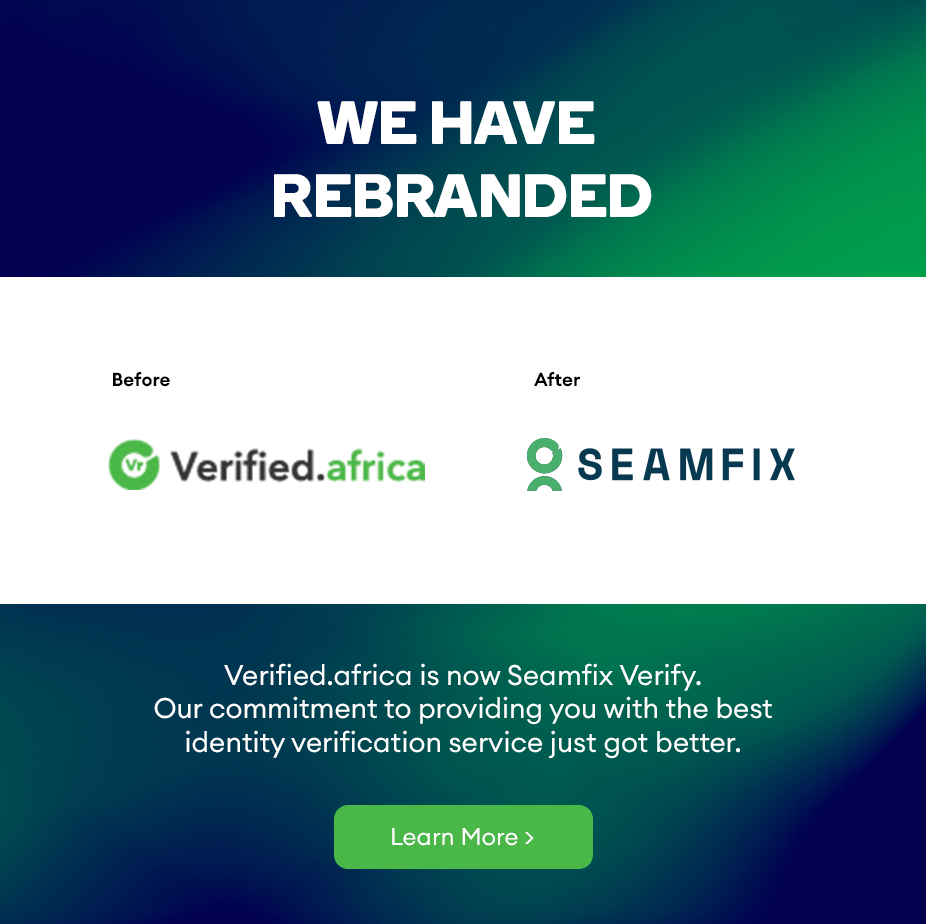

Verified.africa currently enables First Bank of Nigeria to facilitate financial inclusion by verifying the identities of Nigerians who want to open accounts.

These verifications are done using our NIN and BVN services. First Bank’s agents are able to successfully onboard the customers with their systems using Verified.africa’s API.

Because of Verified.africa, First Bank of Nigeria went from getting their identity verification results in 24 hours to seconds. This was a big milestone for the company as it ensured a faster onboarding process almost overnight.

Our NIN verification service enables these agents to authenticate the identities of customers that they want to create accounts for. The agents leverage their customer’s NIN for field account opening, and in return, generate a BVN for those customers who do not have one (BVN).

Our platform equally ensures that the information submitted by the customer is real, and unique to them and checks every other box required for their account creation. It also eliminates potential duplications of a customer’s identity by ensuring that their data is not being used by fraudulent individuals.

This solution has also made banking easier for the elderly, created banking opportunities for those who are less educated about it, reduced paperwork by automating processes and decreased the number of people queuing physically at the bank for the purpose of account creation.

By using verified.africa, First Bank also eliminated redundancies and enabled their workers to be more productive at work.

In Conclusion

Verified.africa aims to empower businesses with quick and accurate identity validation for their customers, ultimately fostering trust and transparency in their business transactions.

In less than three years, we’ve conducted over one million customer verifications across Africa.

Let’s help your business build trust with customers. Check out this post to read our case study on Bamboo.

Our goal is to serve and keep our customers – and their customers – happy and satisfied. Get started with Verified.africa today.