A virtual call on Google Meet comes to life: I unmute my mic to speak with Thea Sommerseth Myhren, CEO and co-founder of Diwala. We’re about to discuss her company’s digital credentialing work in Uganda. It was like meeting for coffee, only behind a webcam and keypads.

“I think we’re all set. Just to be safe, though, I’m bringing in another transcriber,” I started, knowing how tricky transcription AI tools can be.

“Oh, I get you. While doing my Master’s program, I had to transcribe over forty interviews manually. What a process!” Thea chimed in, and we laughed about our experiences.

“Thank goodness for AI, right?” Our shared appreciation for technology set a comfortable tone for our conversation.

A Mission for Digital Empowerment

With the ice broken, we segued into the heart of our discussion.

“Diwala’s journey began with the belief that everyone should have access to their information. It’s about proving who you are and what you’ve accomplished.” Thea’s voice reflected her passion. Her words carried the weight of her experiences living abroad for 16 years in Africa, where accessing and verifying information was difficult.

“Trust is fundamentally broken,” she explained, referring to systems built around control and authority. “And it’s not just local; this is a global problem. Right now, we lack a way to bring transparency and accountability to what people say and do.”

Her narrative painted a clear picture. After completing her Master’s in decentralised identity and privacy-focused infrastructure, she saw a market opportunity that intertwined her journey with a unique problem. “Africa, with its rapid population growth and youthful demographics, is a massive market that goes beyond providing services. We’re looking to empower people with the right data and information,”

Our call evolved into a shared space where ideas flowed freely, creating a sense of connection across borders, from Nigeria to Uganda – two countries where our KYC services are making a significant impact.

A Shared Vision of Trust

Thea’s statement on trust is a powerful sentiment that echoed our work at Verified.africa, where we connect businesses and customers by quickly validating their identity using biometrics and documents. We believe trustworthy identities are essential to fostering trust between individuals and across transactions.

Shifting gears, I asked Thea whether any significant challenges had shaped her perspective on the importance of her work.

“Right. Excellent question.” She began, recounting a challenging period during the COVID-19 lockdown in Uganda when someone robbed her. She lost her phone and a chip containing crucial information, including codes for her bank ID and digital identity.

“I was locked out of any governmental service in Norway for over nine months, with hurdle after hurdle trying to regain access—everything from taxes, my health ID, and banking. So I couldn’t even access my own money. And that showed me that this isn’t a problem solely in Uganda, Nigeria or South Africa. ”

Her experience underscored the urgency of our interwoven mission – to empower individuals with control over their digital identities, ensuring that no one was left helpless due to bureaucratic constraints or digital vulnerabilities.

Ensuring Inclusivity and Accessibility:

Born and raised in Norway, Thea possesses a Norwegian Passport, giving her visa-free access to 187 destinations worldwide. It’s a sharp contrast to the reality many face in Africa, where passports don’t have the same access as those from Europe—a privilege she acknowledges.

To understand the local situation, she and her co-founder, Marina Isaksen Sellstad, spent three and a half years on the ground, travelling to refugee camps and marginalised areas, working with youth foundations, and understanding digital literacy challenges.

“We worked for over two years with organisations with no digital infrastructure, so the core of our ethos in the company is to have human-centred design principles around everything we build”.

Transforming Identity Verification in Africa with Digital Credentials.

This understanding led to creating a “proof of training credential,” Thea continued. The goal was to provide a way for anyone with limited resources to access a training course and receive an identifier that could be a foundational element for building trust. This approach was inclusive by design, catering to those who might not have a national ID or other authoritative identifiers.

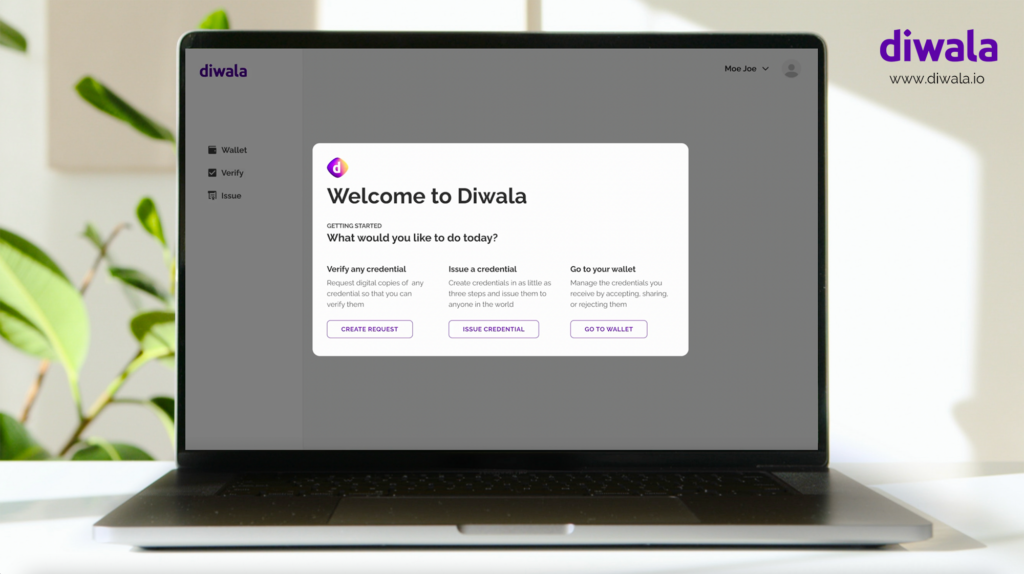

“We can’t just assume that everybody knows what credentialing is, so we guide users through a simple and intuitive process, ensuring our platform is accessible and understandable right from the start”.

Intrigued by the concept, I posed a pivotal question: “Can you explain digital credentialing and elaborate on its impact on identity verification?”

“Absolutely,” Thea responded. “A digital Credential is designed to offer you a distinct and exclusive online representation, similar to the foundation of a house, holding vital data that spans from national IDs to educational certificates.”

The concept is simple and profound – a digital address that embodies an individual’s identity and actions, serving as a trusted entity that remains universally accessible.

“As a Credentialing company, our mission is to foster a world where the data you see is trustworthy, whether you’re an individual or a business.”

Diwala’s strategy encompasses smartphone apps and web access for diverse access points, so even if a person’s smartphone is lost or shared among several people, access to their digital identity remains intact.

Addressing Digital Verification Challenges

Transitioning smoothly, I raised another query: “I’m intrigued. When organisations and individuals seek to verify credentials, what are their primary challenges, and how does Diwala tackle these issues head-on?”

Thea promptly responded by shedding light on outdated manual processes devoid of security and transparency. These traditional methods included physical visits, phone calls, or emails, with the primary hurdle revolving around authenticity.

“Once we issue credentials, they’re encrypted and rendered immutable. We give each organisation and individual a unique identifier, leading us to issue credentials aligned with their data standards, ensuring the information remains tamper-proof and genuine.”

Expanding on this, Thea highlighted the foundational role of data ethics within Diwala’s ethos. She emphasised the significance of Consent, where users have complete authority to permit or restrict the sharing of their credentials.

Additionally, she pointed out their collaborative efforts with KYC companies like Verified.africa, leveraging resources such as national IDs and biometrics to protect individual identities to enhance the overall process, lending greater credibility and reliability to the identity verification ecosystem.

Impacting Businesses and Individuals in Africa with Digital Credentials

Nine hours away from Diwala’s headquarters in Kampala, pictures of verified credentials hung at a pharmacy. It’s a testament, a showoff to customers, that the pharmacy’s owners were part of Stanbic Bank’s Business Incubator in 2020 in Kampala, Uganda.

Through Diwala’s collaboration with the incubator, small to medium-sized businesses gained invaluable resources through training, diligence checks, and the issuance of credentials, empowering these enterprises to present themselves on a global stage and seamlessly tap into opportunities.

Thea also shared a story from a Binance event where a Ugandan coder, Prossy, praised Diwala’s work in securing her credentials, validating the authenticity of her journey and the potential of her solution. This success story underscores the importance of digital credentials in fostering innovation, empowerment, and opportunities for individuals across Africa.”

.

Future Goals for Identity Verification in Africa

As our conversation neared its climax, Thea’s vision for ID verification in Africa came into focus. Looking ahead, she hopes the industry will recognise the magnitude of the problem and prioritise collaborative solutions, with Diwala standing shoulder to shoulder with other companies as distribution partners, forging a united front to develop the digital identification landscape.

“I believe that we can create a unified front where credentials can be an add-on service towards digital identity and be a representative of a person. That’s very far, but you have got to start somewhere. But that’s what I would love to see. We can start with one thing. What is the one thing that can ensure this is okay to identify?”

“If only there could be an initiative akin to a sandbox environment, fostering rigorous risk assessment and innovative solutions. Often, we are so accustomed to the status quo that we don’t even trust that there can be a new way.”

With the conversation drawing to a close, a deep sense of gratitude welled within me for the valuable insights Thea shared. Before leaving our meeting for another engagement, she mentioned her upcoming summer break– fully earned after six years of non-stop work. I extended my best wishes to her, and she, in turn, advised me to consider taking a break as well.

“Even if it’s just a couple of days, sometimes it helps the brain.”

Her parting note was empathetic, encapsulating the ethos that propels visionaries like Thea and her co-founder Marina. It expressed the essence of our conversation: the extraordinary potential that digital identity and credentials hold for each individual across Africa.

And why not commence your digital identity journey with Verified.africa? Explore our solutions, including Face Match and address verification, document verification, and background cleanup. These tools seamlessly connect your business with the right customers in key African countries such as Nigeria, Ghana, Kenya, South Africa, and Uganda.

Sign up for free or book a demo call with our sales experts now.