Remember the Star Wars movie? Artificial Intelligence (AI) is not limited to science fiction alone; it’s a technological powerhouse transforming industries across the globe. In simple terms, AI refers to machines or computer systems that can perform tasks that typically require human intelligence. Think of AI as the digital brain that can learn, reason, and make decisions.

In the context of modern tech, AI is the driving force behind predictive algorithms, autonomous vehicles, virtual assistants, and even the recommendations you receive on streaming platforms. Its ability to process vast amounts of data at lightning speed and make sense of complex patterns makes it a game-changer in various fields, and KYC is no exception.

Documents that took days to review and verify are now processed in seconds. AI-powered systems analyse customer documentation, cross-referencing with governmental databases to spot matches, anomalies, and potential risks. AI gives KYC a makeover by automating the traditionally manual and time-consuming tasks of document verification, risk assessment, and anomaly detection.

This blog details AI and biometrics in KYC, exploring their pivotal roles in enhancing secure and remote identity verification so your business can leverage them efficiently to drive revenue and customer trust.

Biometrics in Identity Verification

At its core, Biometric KYC uses distinct physical or behavioural traits to verify an individual’s identity. It’s like a digital storehouse that’s virtually impossible to replicate. Across industries, such as finance, healthcare, and online services, Biometric KYC is the cornerstone for building trust, preventing fraudulent activities, complying with regulatory standards and protecting sensitive information.

Imagine walking up to an ATM, placing your finger on a scanner, and accessing your bank services. There are no PINs to remember and no cards to insert. This is the power of fingerprint recognition, one of the most widely adopted biometric modalities. But biometrics doesn’t stop at fingerprints. Iris scanning, using the intricate patterns in your eye, provides another layer of security. Voice recognition adds a touch of the futuristic, allowing you to access services simply by speaking. And then there’s facial recognition, the poster child of biometrics, which analyses the unique features of your face for identification.

Why should you adopt biometrics for ID verification? For starters, it’s a security castle that’s nearly impenetrable. Unlike passwords or PINs, which can be lost, forgotten, or stolen, your biometric traits are inherently yours, simplifying the user experience.

Whether it’s guest check-in at a hotel or accessing your online banking, biometrics is creating a seamless bridge between your business and millions of online customers.

As the global biometric market’s revenue surged to $43 billion in 2022 and may reach $83 billion by 2027, the convergence of AI and biometrics is shaping a new method of customer onboarding—one where security and convenience walk hand in hand.

AI-Powered Face Match and Liveness Detection

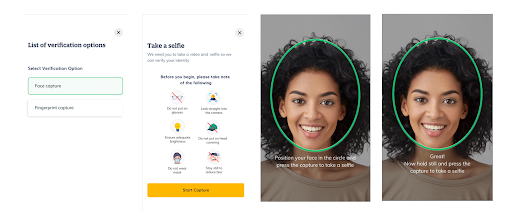

Face match technology involves using algorithms to compare live images of an individual with reference images, typically taken from official documents like passports or driver’s licenses. The process determines whether the person in the live image is the same as the person in the reference image, thereby verifying their identity.

How Face Match Works:

Face Match employs advanced machine learning algorithms to analyse facial features and patterns. When a user submits a live image (selfie) and a reference image (e.g., passport photo), the system extracts key facial landmarks, such as the distance between the eyes, the nose shape, and the jawline’s contours. These features are converted into numerical data and compared between the live and reference images. The system calculates a similarity score that indicates how closely the two images match – all done in seconds!

Introducing Liveness Detection:

Liveness detection, on the other hand, is a crucial component of biometric authentication systems that prevents spoofing attempts. Spoofing involves using static images, videos, or masks to impersonate a live person. Liveness detection adds an extra layer of security by ensuring the authenticated individual is physically present, not just a digital representation.

How Liveness Detection works:

There are two significant types of liveness tests:

- Passive Liveness Detection: Distinguish between a live face and a static image or video. For instance, if someone tries to gain access to your bank account using a photo from your social media, our AI is trained to detect the lack of vitality in the image, promptly denying access and raising the alarm for potential fraud.

- Active Liveness Detection: Analyze the subject’s behaviour patterns, requiring them to perform specific actions to prove their presence. Afterwards, our face match feature corroborates the live image with a target image, such as their national ID card, for a more comprehensive identity verification process.

As you validate that your customer is genuine and physically present through their biometrics, your business can confidently onboard customers and provide swift access to your services. Something we all want 🙂

Verified.africa, a platform using AI-powered face match and liveness detection, offers various verification workflows:

- Face Capture Only: Capture customer images alone for seamless verification.

- Face Capture Plus Face Match: Add an extra layer of security by comparing a live image with a reference image.

- Face Capture Plus ID Match: Verify facial details and identification documents side by side for an accurate onboarding experience.

We’ve implemented these workflows in various industries, including:

- Telecommunications: Preventing sim swap fraud by verifying images.

- Fintech: Simplifying sign-up and sign-in with real-time authenticity checks.

- Banking: Matching live images with stored images for secure transactions.

- Ride-Hailing: Validating driver and passenger identities for platform security.

- Hospitality: Streamlining guest check-ins with real-time AI checks.

With our services, businesses can enhance security, comply with regulations, reduce fraud, and provide a seamless user experience. Here’s how we’ve done so for some of Africa’s most trustworthy brands.

Case Study: Verified.africa’s Advanced Solutions:

MTN’s Enhanced Verification Process:

MTN, Africa’s most extensive network operator, recognised the critical need for a secure verification process for customers registering for SIM cards or requesting SIM swaps. To achieve this, MTN integrated Verified.africa’s AI technology, incorporating background cleanup, face matching engine, and passive liveness detection checks.

This integration significantly elevated the accuracy of image matching. By leveraging Verified.africa’s advanced solutions, MTN successfully enhanced customer verification, slashing digital fraud by up to 90% and accelerating customer onboarding by 100%.

Union Bank’s BVN Facial Matching:

Union Bank, a pioneering commercial bank, aimed to precisely match customer-provided pictures with images stored in the NIBSS database while opening digital bank accounts. Through API integration with Verified.africa, Union Bank performed BVN facial matching with precision, enhancing the accuracy and security of their identity verification process, leading to the swift onboarding of thousands of customers.

Invest Bamboo: Tackling Dual Identities with Real-Time Verification

Invest Bamboo, a Nigerian brokerage firm, encountered identity fraud threats like dual identities during customer onboarding. To overcome this hurdle, they seamlessly integrated Verified.africa’s real-time verification API into their mobile app, enabling authentication of National Identification Numbers (NIN) and Bank Verification Numbers (BVN), effectively preventing instances of dual identities. The outcome? A streamlined process that bolstered user trust and eradicated fraudulent activities, allowing Invest Bamboo to process over 5,000 sign-ups monthly successfully.

These case studies exemplify Verified.africa’s dedication to delivering AI-powered solutions that tackle distinctive identity verification challenges and enhance security for businesses and their customers.

Moreover, our solutions prioritise data privacy and compliance, ensuring that only essential information is collected and processed. Through this rigorous approach, we foster trust with customers and empower businesses to navigate regulatory and privacy concerns adeptly.

Getting Started with Verified.africa:

Verified.africa offers a comprehensive suite of AI-powered KYC solutions that seamlessly connect businesses with genuine customers, facilitating secure and efficient onboarding. Focusing on African markets such as Nigeria, Ghana, Kenya, South Africa, and Uganda, Verified.africa empowers businesses to establish trust and compliance.

To learn more, schedule a free demo session with our product experts. During this session, you can discuss your unique requirements and explore the tailored solutions best suited for your business. Our dedicated team will collaborate closely with you to design a customised integration process, leveraging SDKs and APIs to seamlessly implement the face match and liveness detection services directly into your workflow.

Our success stories exemplify the concrete benefits of integrating our solutions, from thwarting dual identities to enhancing verification accuracy for leading organisations.

Whether you’re a startup or an established enterprise, Verified.africa is committed to aiding you in meeting your KYC requirements and delivering extraordinary customer experiences. First, sign up for free or book a demo today, and start enjoying Verified.africa’s AI-powered solutions.